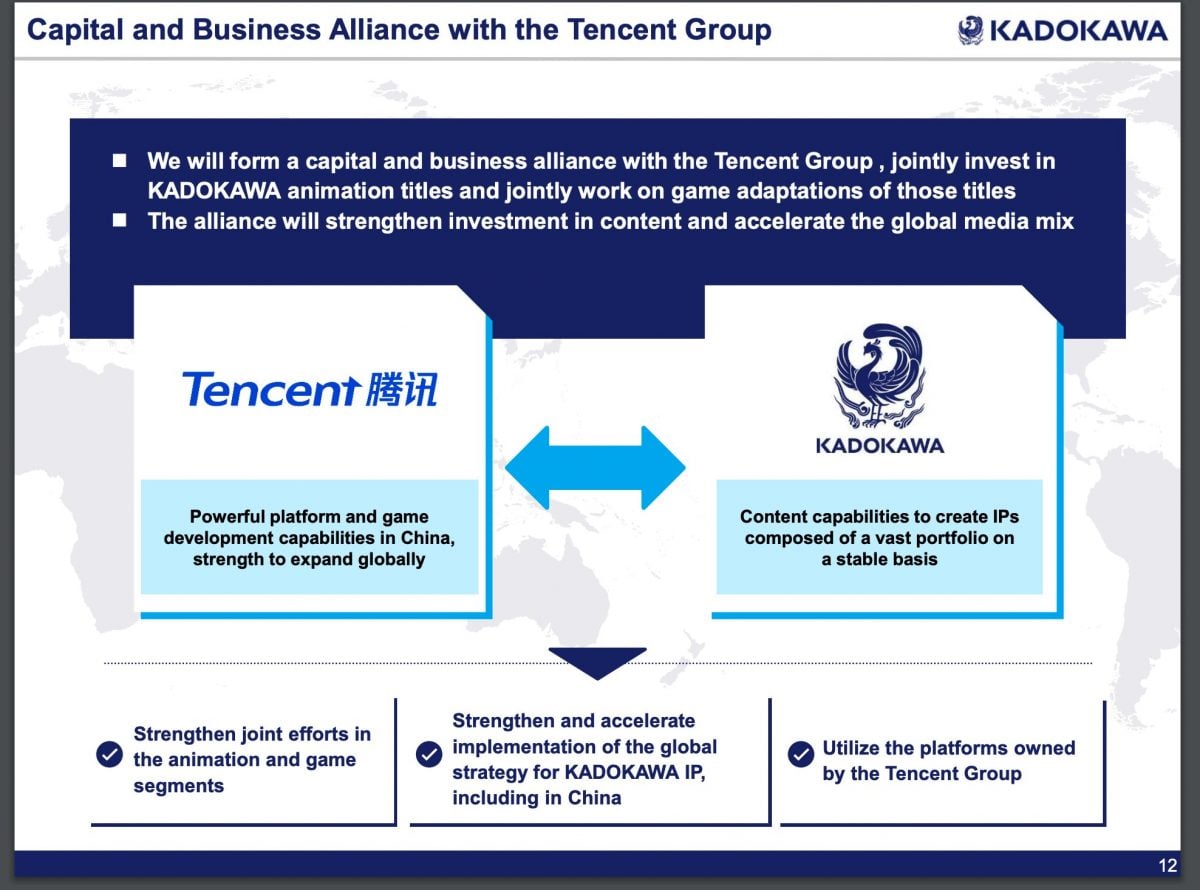

In a surprising turn of events, or perhaps an unsurprising one, Chinese conglomerate Tencent Holdings looks set to gain a stake in another foreign enterprise. Only this time, it’s publishing giant Kadokawa, as revealed by the Japanese firm itself in a recent stock exchange filing. According to a Nikkei Asia report on October 29th, 2021, the company “has decided to enter into a business alliance agreement with Tencent Group for the anime business to further promote the company’s IP-based Global Media Mix.” It was announced that this will be through Hong Kong-based Tencent subsidiary Sixjoy buying 4.86 million shares for 6,170 yen per share, or around 30 billion yen ($264 million), which would take place sometime between November 15th and 26th. This was also confirmed by Dr. Serkan Toto of Kantan Games that same day.

Today, Japanese mega publishing house Kadokawa said Tencent acquired a 6.86% stake for US$264 million.

Kadokawa is From Software's parent company and said the capital will be used for producing games (among other things) going forward.

Tencent's biggest bounty in Japan so far. pic.twitter.com/aYnDulADzV

— Dr. Serkan Toto / Kantan Games Inc. (@serkantoto) October 29, 2021

As stated above, this translates into Tencent acquiring about 7% of the Japanese publisher, which would make it the firm’s third-largest stakeholder. Meanwhile, in an Abema Prime interview, Kadokawa President and CEO Takeshi Natsuno explained why this “alliance” was made:

“In particular, Tencent is very interested in adapting anime works into games. Tencent wanted to be a part of the anime production committee, and we agreed to a partnership that would give us the right to develop the game in China, depending on the percentage of investment, which led to this partnership. China is also a difficult market for us, and we needed a partner.”

While Natsuno expressed doubts that anime and game production will shift to China, as it’s no longer conducive to cheap outsourcing due to rising labor costs there, he highlighted how this can potentially open the company’s works to the mainland Chinese market, which would otherwise be near-impossible without local support. As he put it, “we decided that we had more to gain than to lose from the partnership with Tencent.”

You’d think that this would be a windfall for Kadokawa, as it can mean being able to invest the proceeds to secure editors and producers for more projects. Reception to this development, however, has been far from glowing. As Cartoon Brew‘s Alex Dudok de Wit highlighted, Tencent has been trying to extend its reach with various gaming and animation companies across the world, even as it faces a growing regulatory crackdown in China. Given the long-standing concerns about the conglomerate, whether it’s the wildly inconsistent quality in its games or a shady relationship with data security, these have already started raising eyebrows.

https://twitter.com/CLOE42009936/status/1454442944765718534

Some raised concerns that, while a relatively small acquisition in the bigger picture, Tencent’s presence in one of Japan’s largest publishers, and by extension the anime industry, may risk “selling out” to Chinese-style regulation, or worse. On top of being more than a little reminiscent of Takeshi Natsuno’s infamous remarks on endorsing manga censorship just a few months ago, this has once again revived fears of freedom of expression being challenged. This may potentially set a negative precedent for anime as you know it:

https://twitter.com/SniperKnighter/status/1454566980795633669

In addition to such issues, some have expressed fears that the Chinese conglomerate’s investment will only encourage excesses in the industry, at the risk of fostering even more appalling MAPPA-style work conditions that would prove taxing for animators:

This is alarming as while I'm scared about censorship being imposed on all media, Kadokawa will use Tencent's money to make 40 or more shows per year which is quite taxing for anime studios. https://t.co/vdH9OOuhtW

— ベニグマティッカ (@Benigmatica) October 29, 2021

While there are those who were neither surprised nor all that shocked at this news, the deal hasn’t exactly painted either party in a good light in their eyes:

https://twitter.com/frog_kun/status/1454233154479276035

Overall, these could put Kadokawa’s ambitious “overseas first” campaign to be internationally competitive, especially against the likes of Netflix, into jeopardy by poisoning the well. At this stage, however, it’s still up in the air how things will play out. While the full ramifications may be out of my paygrade to even imagine, it’s definitely something to keep a tab on. But what are your thoughts?