Running an international anime company for the past 16 years has been interesting, and I’ve learned a lot about both countries in the process. As a general rule, legal institutions that exist in the U.S. are also present in Japan, and if you have a concept in one country it will probably translate into something similar on the other end. Part of this comes from Western countries following the Generally Accepted Accounting Principles (GAAP) so that their laws can inter-operate, but a lot of Japan’s lock-step movement with the U.S. comes from a deeper tradition of generally following behind us in all things — for example, Japan’s version of the 401(k) is ingeniously named the “Japan 401(k).” There’s one concept that exists in Japan which is quite different from the States, however. It’s called gensen choshu and it means withholding taxes on income at the source, which is what happens when you get your paycheck with tax already taken out — but in Japan, these taxes are per-deducted in a wider range of situations. If we were to hire a programmer or artist to do some work for us, we’re required by law to per-deduct their taxes when we pay them, hence for a $1000 job we’d pay him $850 and send the rest to the Tax Ministry in their name, presumably to keep the payment from going unreported. This is a minor inconvenience, but I was surprised to learn that investment income is also pre-deducted in the same way. So when my wife puts money in a CD at 1% interest (still considered a fairly good return in Japan), she actually only gets .85% from it, which means she’s potentially losing up to a year of earnable interest from other investments because the taxes are taken off the top instead of calculated at the end of the year. I’m sure taxpayers would rise up and revolt over something like this in most countries, but sadly the Japanese mantra of sho ga nai (“it can’t be helped”) keeps people from demanding change here.

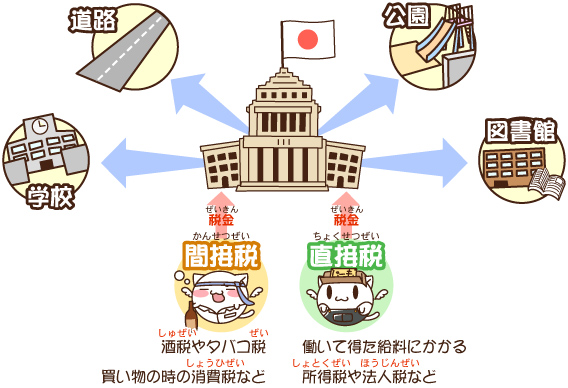

A cute graphic explaining how the Japanese government spends our tax money.